This article was published in the 4E Journal 3Q2021, written by Alvin Kwan – Redvest’s Head of Financial Planning

It’s natural to be concerned about our children’s safety,health and future. What isworrisome about today’s young generation is how they are bombarded by advertisements, online shopping, peer pressure and Instagram culture. Recent surveys highlighted that millennials were left without much advice they can use when it comes to financial planning as an adult. So, it would be prudent to avoid that for the

following Gen Z which are now in their teenage or coming of age years. So, who is to blame? Should

we point our fingers at the advertisers, social media, or the influences of globalisation? Who was in charge of educating them about money? The teachers? The parents? Or society as a whole?

Regardless, it’s time to look forward and help today’s younger generation, especially our teenagers to have a better start in money management. Here are three alternative ways we can teach them.

JOINING THEM INSTEAD OF STOPPING THEM

Online shopping has enabled spending like never before, especially during the pandemic. Like everyone else, teenagers will want to buy and own things if they have the means, although more often than not, such purchases are due to peer influences. Parents being the financial provider for their children, must be able to instill the importance of self-control and wisdom in leisure shopping. It is simply not enough to just tell or nag them. This is a phase of life where teenagers usually become more rebellious and tend to defy adult authority. The old saying has never been truer – “If you can’t stop them, join them”.

Go on Shopee or Lazada with them. Teach them about vouchers, free shipping and sales. Or maybe it is the other way around where they are the ones teaching you instead. Whichever it is, shopping online with them has its benefits:

- Bonding time and relationship building with your teenager

- Slot in some advice about quality versus quantity, self-control and impulsive buying

- Monitor your teenager’s shopping behaviour, what is in their shopping cart, wishlist and their shopping history

- Share your experiences and mistakes about shopping and spending

GIVE PRAISE AND ADVICE

Teenagers are rebellious creatures! It is so true that it must be reminded once again. Nagging and telling them what to do just won’t cut it. It didn’t work for teenagers during the 80s, 90s, and 2000s, and it certainly will not work today. However, teenagers do seek your approval and appreciation, especially on matters of importance to them. Often, we hear them saying “my parents do not understand me” or “my parents are just not cool”. One way to avoid such statements is to acknowledge and sometimes praise them when they are doing right (or even vaguely right) financially.

Examples of phrases of praise:

“It looks like you did not spend too much today at the mall. Good job.”

“You found a real bargain with the dress you bought online. You certainly know how to shop.”

After praise is given, teenagers will be more receptive towards advice. The acknowledgement that they

did something right gives them a sense of pride and the urge to do it better.

LET THEM MAKE MISTAKES AND SHARE YOURS WITH THEM

If you recall how you sharpened your money management skills, more often than not, it wasn’t taught by

your own parents. You learnt either by experience, hardships, or through mistakes you have made. Depending on your generation, we grew up in a different time and culture than teenagers of today.

One way we can teach our teenagers about money management is not by teaching or telling, but by

letting them experience mistakes on their own. Here are ways you can set the stage for your teenager to learn some money management.

- The salary and lending method –

- Provide a “salary” by doing chores instead of allowances.

- Let them freely manage their money in terms of allowance, food, shopping and leisure.

- If they request for more, tell them they can only borrow.

- Charge them a high interest and claim it from the next “salary”.

- Let them go into a spiral of debt until they learn from it.

- The delayed gratification lesson

- We are spoilt with instant gratification. What we want, we usually can get it quickly; if not almost instantly. Netflix (with movies and entertainment), Grab (with food or transport), Shopee (with shopping), WhatsApp (with communication) and etc. The Gen Z of today are born into instant gratification. However, the culture of savings and investments are more often than not, a slow and disciplined process. It’s even more crucial that parents practise delayed gratification with teenagers and resist buying things they want versus what they really need. For example, if they ask to buy something they want (big or small), try and ask them to wait for a few weeks or months. If they want it sooner, this is their chance to contribute part of the cost too. There is a chance that as time passes, they would realise that the purchase is not worth their allowance money and that their desire for it may even fade.

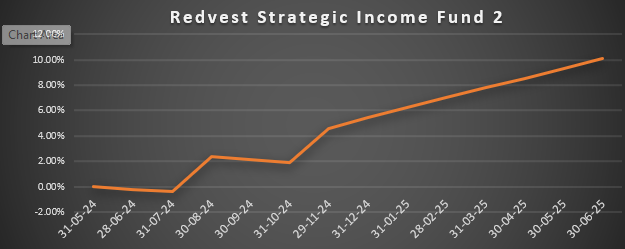

- The compounding interest lesson

- Open a bank account for your teenager with some sort of interest element in it and allocate your teenager’s allowance in them. Alternatively, some e-wallets currently have an interest element in them as well. This allows them to learn about the compounding effect of interest upon interest. With this method, you can teach them about saving their allowances, and see how their savings would grow each month. Take this opportunity to teach them about inflation and how other forms of investments can make their savings grow even faster, such as fixed deposits or a bond fund. Although they are too young to invest into unit trusts themselves as a primary applicant, you can create a joint unit trust account with your teenager being the secondary account holder.