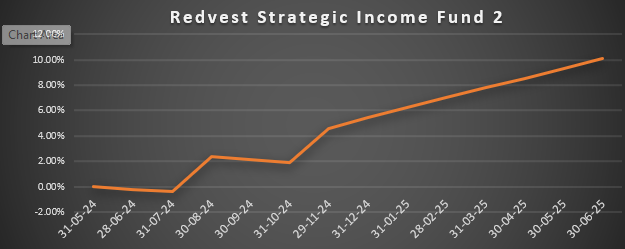

The Redvest Strategic Income Fund 2 has delivered an impressive 10.02% return over its first 13 months, outstripping its projected annual yield and validating its alternative approach to fixed income investing.

Commenced in June 2024 by Redvest Wealth & Asset Management, the wholesale fund was designed to offer premium passive income through Shariah-compliant private securities. Its unique structure taps into high-yield investments such as Pinnacle Subang Jaya, a prominent development project backed by guaranteed sales and corporate guarantees ensuring both capital preservation and recurring returns. The take up of Pinnacle Subang Jaya’s units is 97.5% sold out. They achieved a 99% conversion/take up rate with just 19 months from its launch in July 2023.

📌 Key Highlights

- Actual Return: 10.02% in 13 months

- Target Return: Previously estimated at 9% p.a.

- Income Distribution: Paid quarterly with options to reinvest or cash out

- Redemption Restriction: 18-month lock-in with flexible quarterly liquidity thereafter

- Investment Style: Focused on secure, income-generating assets insulated from public market volatility

| 3 month | 6 month | 12 month | Since Commencement | |

| Fund | 2.32% | 3.85% | 10.52% | 10.07% |

| Benchmark | 0.61% | 1.23% | 2.45% | 2.65% |

Fund Positioning: A Premium Alternative

Unlike traditional bond funds, which often suffer from interest rate sensitivity and uneven performance, Redvest’s approach offers HNW investors a consistently high yield without the turbulence. The fund is equally positioned as a compelling alternative to fixed deposits, which are often criticized for underwhelming returns in inflationary environments.

Strategic Role in Portfolio Planning

- Acts as a Fixed Deposit Enhancer for better yield

- Serves as a Low-Volatility Anchor in diversified portfolios

- Aligns well with medium- to long-term goals like retirement planning or capital expenditure forecasting

Leadership Insight

Alvin Kwan, Executive Director of Redvest, noted:

“This performance is a clear reflection of our rigorous security selection and capital protection measures. The Fund’s success highlights the value of private market investments when structured with proper governance, Shariah oversight, and aligned partnerships.”

The fund’s early success has reinforced Redvest’s reputation for innovation and reliability in alternative asset management, delivering not just returns, but confidence in a market where both are increasingly rare.